Python - with BIAS & RSI

from pandas_datareader import data as web

from mpl_finance import candlestick_ohlc

from matplotlib import pyplot as plt

from matplotlib import style

import matplotlib.dates as mdates

import yfinance as yf

import datetime as dt

import pandas as pd

import numpy as np

import time

style.use('dark_background')

yf.pdr_override()

ma1 = 5

ma2 = 20

print('Stock Number:')

stock_no = input()

csv_file = '/users/jht/Desktop/python/stockData/'+stock_no+'.csv'

start = dt.datetime(2020, 1, 1)

end = dt.datetime.now()

df = web.get_data_yahoo(stock_no + '.TW', start, end)

df.to_csv(csv_file)

time.sleep(2)

data = pd.read_csv(csv_file, parse_dates=True, index_col='Date')

data.head()

close = data["Close"]

avg = sum(close)/len(close)

top = plt.subplot2grid((21, 9), (0, 0), rowspan=9, colspan=9)#整個畫面共有(21row,9col),其位於(0row,0col),此占各9row&col

bottom = plt.subplot2grid((21, 9), (12, 0), rowspan=3, colspan=9, sharex=top)

bottom1 = plt.subplot2grid((21, 9), (18, 0), rowspan=3, colspan=9, sharex=top)

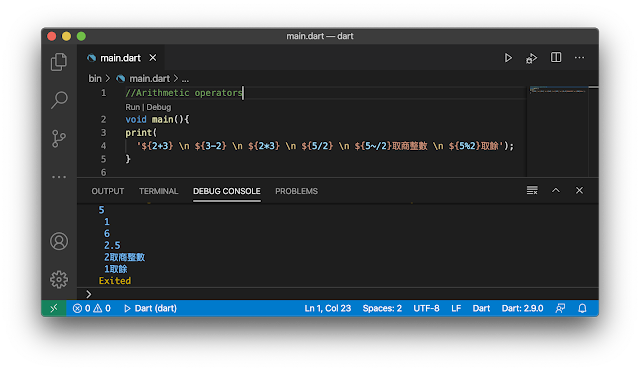

def bias(ma):

data['MA25'] = data['Close'].rolling(window=ma).mean()

data['BIAS'] = (data['Close'] - data['MA25']) / data['MA25'] * 100

return data['BIAS']

def rsi(price, period=6):

import pandas as pd

closedif = (price - price.shift(1)).dropna()

upprc = pd.Series(0, index=closedif.index)

upprc[closedif > 0] = closedif[closedif > 0]

downprc = pd.Series(0, index=closedif.index)

downprc[closedif < 0] = - closedif[closedif < 0]

rsi = []

for i in range(period, len(upprc) + 1):

up_mean = np.mean(upprc.values[(i - period):i], dtype=np.float32)

up_down = np.mean(downprc.values[(i - period):i], dtype=np.float32)

rsi.append(100 * up_mean / (up_mean + up_down))

rsi = pd.Series(rsi, index=closedif.index[(period - 1):])

return (rsi)

bias = bias(5)

rsi1 = rsi(close, ma1)

rsi1.tail()

rsi2 = rsi(close, ma2)

rsi2.tail()

moving_avg1= close.rolling(ma1).mean()

moving_avg2 = close.rolling(ma2).mean()

data = data.reset_index()

data['Date'] = data['Date'].apply(lambda d: mdates.date2num(d.to_pydatetime()))

candlestick = [tuple(x) for x in data[['Date', 'Open', 'High', 'Low', 'Close']].values]

candlestick_ohlc(top, candlestick, width=0.7, colorup='r', colordown='green', alpha=0.8)

top.plot(moving_avg1, color='orange', linewidth=1, alpha=0.7, label=ma1)

top.plot(moving_avg2, color='b', linewidth=1, alpha=0.7, label=ma2)

top.axhline(avg,color='r', alpha=0.3,label='avg')

top.legend()

top.grid(which='both', alpha=0.3)

top.set_title('Stock No: '+ stock_no,color='y')

top.set_ylabel(str(round(avg,5)),color='r', alpha=0.3)

bottom.plot(rsi1, color='orange', linewidth=1, alpha=0.7)

bottom.plot(rsi2, color='b', linewidth=1, alpha=0.7)

bottom.axhline(70, color='gray', alpha=0.3)

bottom.axhline(30, color='gray', alpha=0.3)

bottom.set_ylim(-10, 110)

bottom.set_title('RSI')

bottom1.plot(bias)

bottom1.axhline(0, color='r', alpha=0.3)

bottom1.set_title('BIAS(price vs MA5)')

plt.xlabel('Design by Eve',color='gray',fontsize='7', alpha=0.8)

plt.show()

Comments

Post a Comment